Social Security Withholding Income Limit 2025 - Social Security Tax Limit 2025 Withholding Chart Mavra Sibella, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. Social Security Tax Limit 2025 Withholding Tax Merry Mercedes, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Social Security Tax Limit 2025 Withholding Chart Mavra Sibella, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

The 2025 limit is $168,600, up from $160,200 in 2025. The wage base or earnings limit for the 6.2% social security tax rises every year.

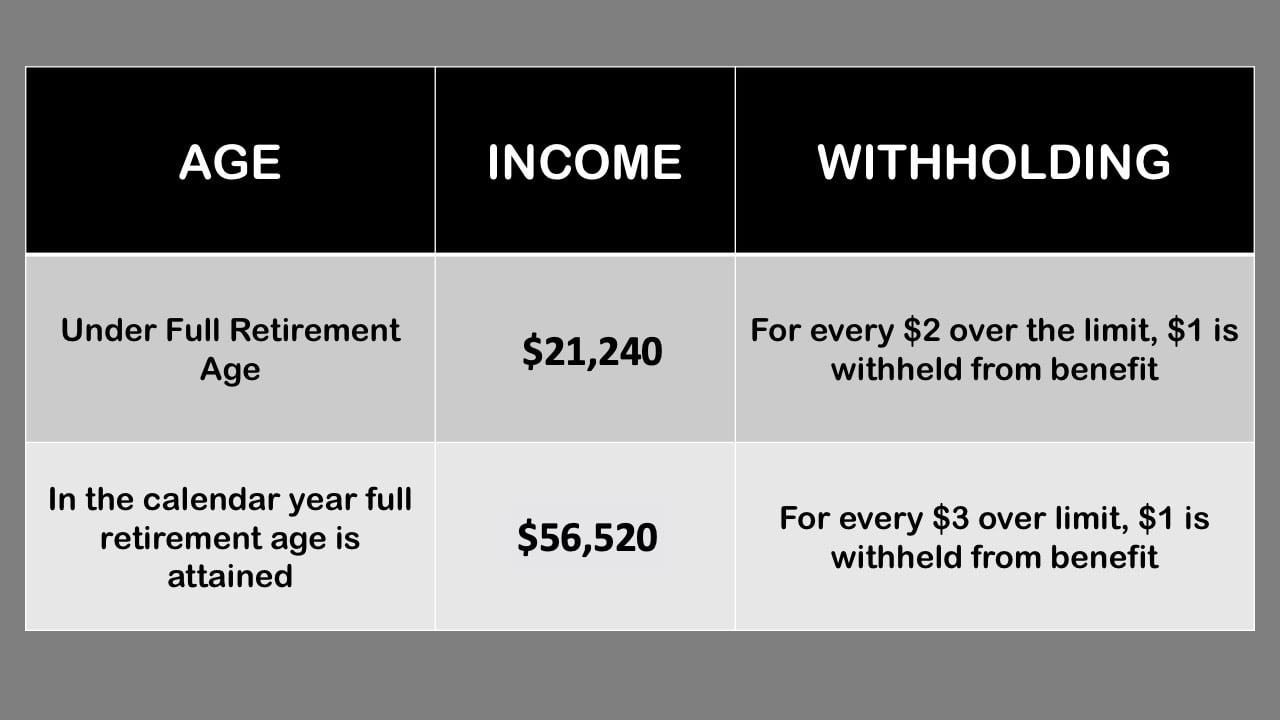

Social Security Tax Limit 2025 Withholding Allowances Afton Alameda, Suppose you turn 62 in 2025 and claim social security.

Social Security Withholding Income Limit 2025. Earnings above that level are not taxed for the. Social security max 2025 income limit.

Social Security Tax Limit 2025 Withholding Tax Sonya Elianore, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, Suppose you turn 62 in 2025 and claim social security.

What'S The Max Social Security Tax For 2025 Maris Shandee, That’s what you will pay if you earn.

Social Security Limit 2025 Withholding Bel Rosemary, You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

2025 Earned Limit For Social Security Ninon Shayna, You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

What Is Max Social Security Withholding 2025 Hildy Latisha, In 2025, the social security tax limit rises to $168,600.

Social Security Tax Limit 2025 Withholding Chart Mavra Sibella, For 2025 that limit is $22,320.